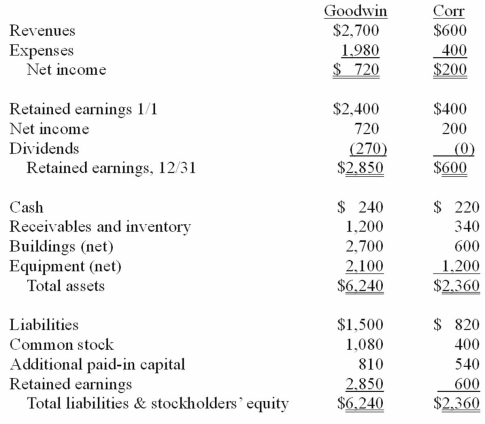

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated expenses for 20X1.

Definitions:

Poor Quality

Refers to products or services that do not meet expected standards or specifications.

Merchandise

Goods that are bought and sold in business.

Legal Aspects

Legal aspects encompass the law-related considerations or implications present in any situation, action, or decision.

Certified Check

A check that has been marked, or certified, by the bank on which it was drawn, guaranteeing payment to the holder.

Q3: The ultimate speed of a solar-sail-propelled spacecraft

Q18: What is the impact on the non-controlling

Q18: Pell Company acquires 80% of Demers Company

Q29: On April 7, 2011, Pate Corp. sold

Q34: On January 1, 20X1, the Moody Company

Q60: Chemical rockets work on which basic physical

Q66: On 4/1/09, Sey Mold Corporation acquired 100%

Q67: An optical SETI signal would most likely

Q96: The financial balances for the Atwood Company

Q114: Pot Co. holds 90% of the common