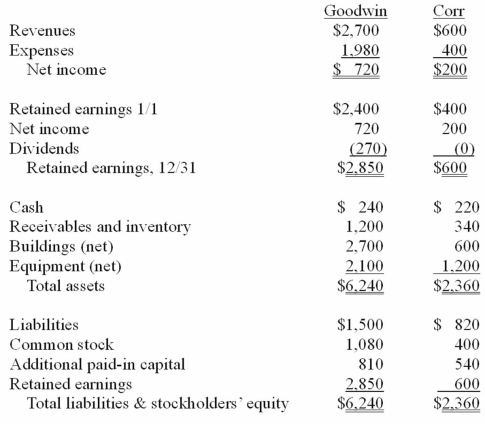

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated cash account at December 31, 20X1.

Definitions:

Biotransformation

The chemical alteration of substances within living organisms, transforming or breaking down substances.

Rate of Absorption

The speed at which a substance is taken into the body or into a material, typically referring to nutrients, drugs, or chemicals.

Subcutaneous

Pertaining to or situated under the skin, often used to describe injections or implants administered beneath the skin layer.

Intrathecal

Intrathecal refers to the administration of drugs or other substances directly into the space under the arachnoid membrane of the brain or spinal cord.

Q3: Denber Co. acquired 60% of the common

Q7: Chapel Hill Company had common stock of

Q38: Stars much more luminous than the Sun

Q57: How is the "Fermi Paradox" normally stated?<br>A)

Q60: What is the spectral type of the

Q67: Anderson, Inc. has owned 70% of its

Q78: Which of the following statements is false

Q93: Why does the Doppler shift method of

Q100: O-type stars in our galaxy are<br>A) very

Q117: Under the partial equity method, the parent