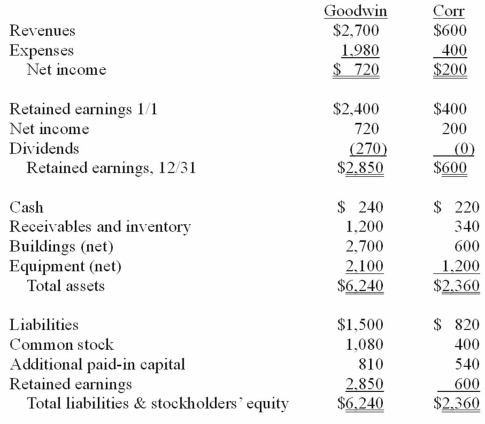

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated equipment (net) account at December 31, 20X1.

Definitions:

Preexisting Duty

A legal principle that states a promise to do something that one is already legally obligated to do is not sufficient consideration for a new contract.

Unilateral Contract

A promise made by one party in exchange for the performance of a task or action by another party.

Past Consideration

A benefit already provided or an action already performed, which cannot legally constitute consideration for a current contract.

Consideration

A value that is exchanged between parties in a contract, making the agreement legally binding.

Q17: Fargus Corporation owned 51% of the voting

Q26: Cayman Inc. bought 30% of Maya Company

Q43: If we were to intercept a strong

Q60: If we allow for a planet with

Q67: An optical SETI signal would most likely

Q71: Jarmon Company owns twenty-three percent of the

Q76: The third planet discovered around the star

Q112: On January 1, 2009, Nichols Company acquired

Q114: On January 4, 2011, Bailey Corp. purchased

Q122: Several years ago Polar Inc. acquired an