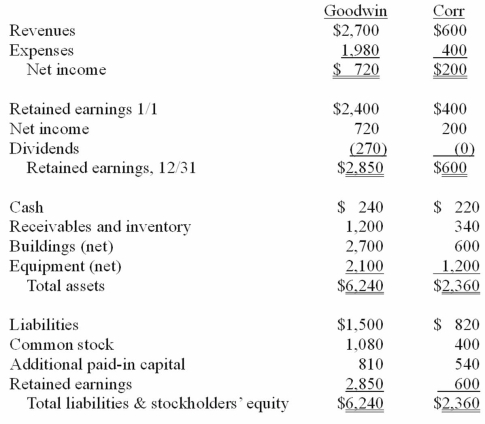

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated additional paid-in capital at December 31, 20X1.

Definitions:

Power Usage

The manner in which authority or power is exercised within various contexts, including political, social, or organizational spheres.

Mass Media

Forms of communication designed to reach large audiences directly through mediums like newspapers, television, radio, and the internet.

User-Pay Costs

Expenses that must be covered by the individual using a service or product, rather than being subsidized by the government or another entity.

Media Conglomeration

The process by which a small number of companies own and control a large proportion of the mass media outlets, such as television networks, radio stations, newspapers, and online platforms.

Q12: Prince Company acquires Duchess, Inc. on January

Q30: Which of the following statements is true

Q38: When Jolt Co. acquired 75% of the

Q38: On January 1, 2011, Jolley Corp. paid

Q47: The antimatter equivalent of a proton is

Q55: Pell Company acquires 80% of Demers Company

Q70: On January 4, 2011, Bailey Corp. purchased

Q73: On January 4, 2011, Mason Co. purchased

Q75: Many of the extrasolar planetary systems discovered

Q102: Virginia Corp. owned all of the voting