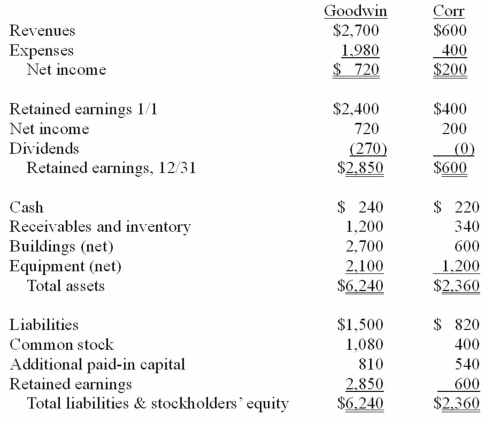

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated retained earnings at December 31, 20X1.

Definitions:

Corn Market

The global or local marketplace where corn is traded as a commodity between buyers and sellers.

Increasing-Cost Industry

An industry in which expansion through the entry of new firms raises the prices firms in the industry must pay for resources and therefore increases their production costs.

Economic Losses

Losses incurred when a company or economy's total costs exceed its total revenues, indicating a negative profit situation.

Industry Supply

The total quantity of a good or service that all producers in an industry are willing and able to sell at various prices over a certain period.

Q5: During the last century, sea levels have

Q11: Why are radio waves probably the most

Q14: What type of civilization would be able

Q18: What is the name of the Japanese

Q41: Einstein's General Theory of Relativity tells us

Q63: How is a non-controlling interest in the

Q82: What is the justification for the timing

Q82: McGuire Company acquired 90 percent of Hogan

Q105: Factors that should be considered in determining

Q126: Walsh Company sells inventory to its subsidiary,