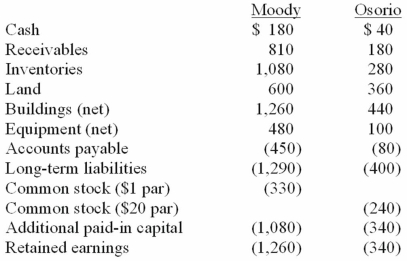

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated land at date of acquisition.

Definitions:

Relaxed

A state of being free from tension and anxiety.

Conditioned Response

A learned response to a previously neutral stimulus that becomes associated with a conditioned stimulus through conditioning.

Dentist's Drill

A tool used by dentists to remove decay from teeth and prepare them for fillings.

Cringing

A physical or emotional reaction of discomfort, embarrassment, or fear, often characterized by shrinking back or cowering.

Q12: Presented below are the financial balances for

Q21: The financial statements for Jode Inc. and

Q24: As global warming progresses, the<br>A) landmasses will

Q35: Apart from its distance from its parent

Q41: Approximately what percentage of people in the

Q45: When our Sun becomes a red giant

Q69: On January 1, 2011, Anderson Company purchased

Q72: Justings Co. owned 80% of Evana Corp.

Q84: On January 4, 2010, Harley, Inc. acquired

Q96: Stark Company, a 90% owned subsidiary of