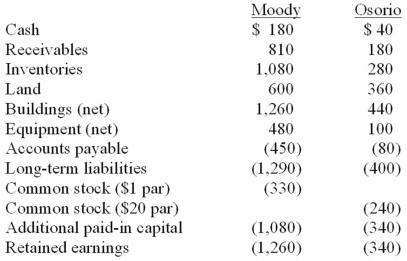

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated equipment at date of acquisition.

Definitions:

Unconscious Feelings

Emotions and desires not immediately available to conscious awareness, often influencing behavior in unseen ways.

Systematic Desensitization

A behavior therapy used to reduce phobic responses and anxiety through gradual exposure to the feared object or situation coupled with relaxation exercises.

Anxiety-Arousing

Inducing or leading to increased feelings of anxiety or stress.

Counterconditioning

A behavior therapy technique that involves replacing an unwanted response to a stimulus with a desired response.

Q16: A company has been using the fair-value

Q18: Flynn acquires 100 percent of the outstanding

Q19: Parent sold land to its subsidiary for

Q41: On November 8, 2011, Power Corp. sold

Q43: On January 1, 2010, Palk Corp. and

Q58: Walsh Company sells inventory to its subsidiary,

Q75: Which of the following statements is false

Q93: Yules Co. acquired Noel Co. in an

Q94: What is preacquisition income?

Q102: On January 3, 2011, Roberts Company purchased