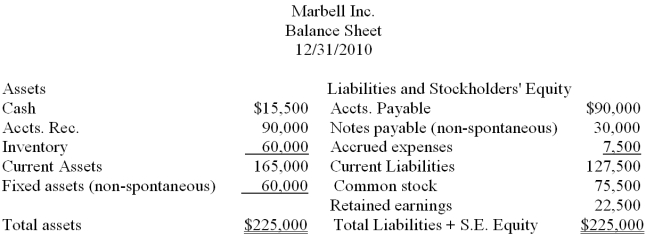

The following is the balance sheet for 2010 for Marbell Inc.

Sales for 2010 were $500,000. Sales for 2011 have been projected to increase by 10%. Assuming that Marbell Inc. is operating below capacity, calculate the amount of new funds required to finance this growth. Marbell has an 8% return on sales and 80% is paid out as dividends.

Definitions:

Beginning Inventory

The value of goods available for sale at the start of an accounting period, carried over from the end of the previous period.

Cost of Goods Sold

This term refers to the direct costs attributable to the production of the goods sold by a company, including the cost of materials and labor.

Perpetual Inventory

An inventory management system where updates are made continuously to record sales and purchases, providing a real-time view of inventory levels.

Purchase Price

The amount of money paid or agreed to be paid by the buyer to acquire an asset, product, or service from a seller.

Q6: Agency theory assumes that corporate managers act

Q7: The use of depreciation is an attempt

Q15: A higher growth rate in sales will

Q30: When actual sales are greater than forecasted

Q66: If the liquidity premium theory was the

Q80: Which of the following is an outflow

Q82: The movement of the exchange rate can

Q101: Which of the following is not a

Q102: Depreciation is an accounting entry and does

Q120: Profitability ratios allow one to measure the