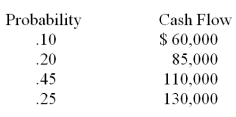

Cooper Construction is considering purchasing new, technologically advanced equipment. The equipment will cost $640,000 with a salvage value of $75,000 at the end of its useful life of 10 years. The equipment is expected to generate additional annual cash inflows with the following probabilities for the next ten years:

a) What is the expected cash flow?

b) Cooper's cost of capital is 10%. What is the expected net present value?

c) Should Cooper buy the equipment?

Definitions:

Hz

Hertz, the unit of frequency in the International System of Units (SI), denoting one cycle per second.

Ossicles

Small bones in the middle ear that transmit sound vibrations from the eardrum to the inner ear; includes the malleus, incus, and stapes.

Hammer

A tool with a heavy, typically metal head attached to a long handle, used for breaking things apart or driving in nails.

Motion Sickness

A condition characterized by a sense of nausea and, sometimes, vomiting that is brought on by the movement of one's body or the perceived movement of one's surroundings.

Q10: The base for depreciation expense calculations is

Q66: Rule 415 allows corporations to quickly take

Q72: Which of the following is false regarding

Q79: The investment banker's function involves all of

Q82: In times of recession, retain earnings decline

Q84: Gray House is issuing bonds paying $95

Q85: Which of the following statements about floating

Q86: You buy a new piece of equipment

Q91: Corporations tend to shift from debt financing

Q92: You will deposit $2,000 today. It will