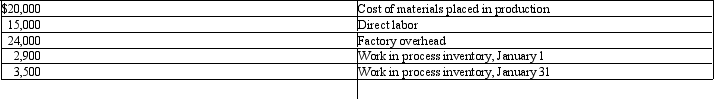

Sienna Company has the following information for January.

Definitions:

Direct Labor Rate Variance

The difference between the actual cost of direct labor and the expected (or standard) cost, used to manage labor costs more effectively.

Standard Rate

A predetermined cost or charge used as a benchmark in budgeting and pricing decisions.

Actual Rate

The real interest rate or cost rate applied in transactions, differentiating from theoretical or expected rates.

Direct Labor Costs

The expenses associated with employees who directly contribute to the production of goods, such as wages for assembly line workers.

Q28: The potential of a tax loss carryforward

Q64: The proper journal entry to record the

Q76: A 2-for-1 stock split is declared. In

Q84: Factory overhead cost is sometimes referred to

Q87: The stockholders' equity portion of Brimstone Tire

Q95: The conversion price divided into the market

Q104: A receiving report is prepared when purchased

Q141: Differentiate between:<br>a) direct materials versus indirect materials<br>b)

Q142: Discuss how equivalent units are computed under

Q168: On January 2nd, Newsprint Manufacturing purchases 5