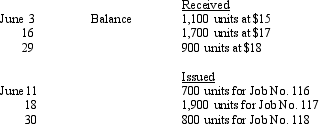

During June, the receipts and issuances of Material No. A2FO are as follows:

Definitions:

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead costs to products, calculated before the period begins based on an estimate of total costs and activity levels.

Manufacturing Overhead

All indirect costs associated with manufacturing, including indirect labor, indirect materials, and other overhead costs that cannot be directly traced to specific items produced.

Work in Process Inventory

The cost accumulated for all materials, labor, and overhead for products that are partially through the production process.

Total Manufacturing Costs

The aggregate of all costs involved in producing a finished product, including direct materials, direct labor, and manufacturing overhead.

Q6: A process cost accounting system provides for

Q29: The following is a list of various

Q34: If fixed costs are $250,000, the unit

Q42: Perpetual inventory controlling accounts and subsidiary ledgers

Q53: A portfolio of international stocks in comparison

Q83: Cordell, Inc. has an operating leverage of

Q95: If the underapplied factory overhead amount is

Q103: If fixed costs are $400,000 and the

Q105: Under variable costing, which of the following

Q122: The following are true regarding product costs