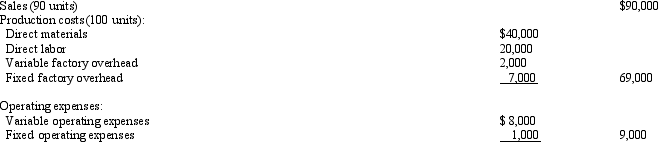

A business operated at 100% of capacity during its first month, with the following results:  What is the amount of the gross profit that would be reported on the absorption costing income statement?

What is the amount of the gross profit that would be reported on the absorption costing income statement?

Definitions:

Tax Rates

The percentages at which income or property is taxed by a government, varying across jurisdictions and income levels.

Charitable Giving

The act of donating money, goods, or time to support nonprofit organizations or causes.

Approaches to Giving

Various methods or strategies adopted by individuals or organizations to donate resources, including time, money, or goods, to charitable causes.

Social Relationships

connections or interactions between individuals or groups, influencing the way people think, feel, and behave towards each other.

Q18: Operating expenses incurred for the entire business

Q24: The use of standards for nonmanufacturing expenses

Q31: Sweet Dreams, Inc. manufactures bedding sets. The

Q66: Dove Corporation began its operations on September

Q75: The production budget is the starting point

Q102: If fixed costs are $490,000, the unit

Q114: The Bottling Department of Mountain Springs Water

Q125: The data required for determining the break-even

Q126: The standard factory overhead rate is $7.50

Q143: The factory superintendent's salary would be included