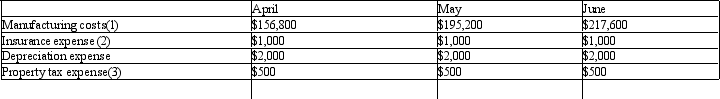

Finch Company began its operations on March 31 of the current year. Finch Co. has the following projected costs:  (1) 3/4 of the manufacturing costs are paid for in the month they are incurred. 1/4 is paid in the following month.

(1) 3/4 of the manufacturing costs are paid for in the month they are incurred. 1/4 is paid in the following month.

(2) Insurance expense is $1,000 a month, however, the insurance is paid four times yearly in the first month of the quarter, i.e. January, April, July, and October.

(3) Property tax is paid once a year in November.

The cash payments for Finch Company in the month of April are:

Definitions:

Income From Operations

The profit realized from a business's operational activities, calculated before taxes and interest charges.

Research and Development Expense

Costs associated with the development of new products or services, which are often categorized as non-recurring expenses within the operational budget.

Statement of Cash Flows

A financial report that provides aggregate data regarding all cash inflows and outflows a company receives from its ongoing operations, investment, and financial activities.

Common Stock

Equity ownership in a corporation, with the right to share in its profits and vote in the annual general meetings.

Q29: Which of the following conditions normally would

Q30: Production and sales estimates for April are

Q33: Tanya Inc.'s static budget for 10,000 units

Q61: The Magnolia Company Division A has income

Q103: If variable selling and administrative expenses totaled

Q120: ABC Corporation has three service departments with

Q129: On the variable costing income statement, all

Q145: For the past year, Pedi Company had

Q160: Consulting the persons affected by a budget

Q187: A company is preparing its their Cash