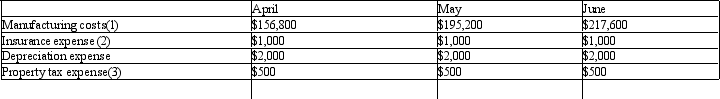

Finch Company began its operations on March 31 of the current year. Finch Co. has the following projected costs:  (1) 3/4 of the manufacturing costs are paid for in the month they are incurred. 1/4 is paid in the following month.

(1) 3/4 of the manufacturing costs are paid for in the month they are incurred. 1/4 is paid in the following month.

(2) Insurance expense is $1,000 a month, however, the insurance is paid four times yearly in the first month of the quarter, i.e. January, April, July, and October.

(3) Property tax is paid once a year in November.

The cash payments for Finch Company in the month of April are:

Definitions:

Profit-Sharing Plan

A company program that offers employees a share in the profits of the business, typically as a form of incentive or bonus.

Merit Pay Plan

A compensation strategy where employees are paid based on their performance or achievements, often intended to motivate and reward excellence.

Gain-Sharing Plan

A compensation strategy where employees receive financial benefits from improvements in the company's performance, encouraging productivity and team effort.

Skill-Based Pay

A compensation system that determines salaries based on the skills or knowledge an employee possesses, rather than their job position or title.

Q2: If the standard to produce a given

Q13: Using the following information, prepare a factory

Q14: In rate of return on investment analysis,

Q35: A formal written statement of management's plans

Q57: Since the costs of producing an intermediate

Q78: Silver River Company sells Products S and

Q121: The ratio of sales to invested assets

Q142: At the end of the fiscal year,

Q145: For the past year, Pedi Company had

Q155: The manufacturing cost of Carrie Industries for