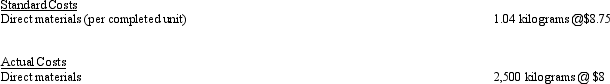

The standard costs and actual costs for direct materials for the manufacture of 3,000 actual units of product are as follows:  The amount of direct materials price variance is:

The amount of direct materials price variance is:

Definitions:

Overhead Cost

Expenses related to the operation of a business that are not directly tied to a specific product or service, such as rent and utilities.

Activity Cost Pools

Groupings of individual costs associated with specific activities used in activity-based costing to allocate costs more accurately.

Activity-Based Costing

An accounting method that assigns costs to products or services based on the activities they require, improving cost accuracy.

Direct Labor-Hours

The cumulative hours put in by workers who are directly engaged in the production process.

Q12: Compute the standard cost for one hat,

Q17: A business operated at 100% of capacity

Q24: The level of inventory of a manufactured

Q52: Which of the following would not be

Q57: A manager in a cost center also

Q81: Under the cost price approach, the transfer

Q92: The variance from standard for factory overhead

Q126: The standard factory overhead rate is $7.50

Q134: Magpie Corporation uses the total cost concept

Q190: The Keith Company reports the following data.<br>