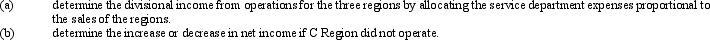

Using the data from the Coffee & Cocoa Company,

Definitions:

Social Security Tax

A payroll tax that finances the United States' social security program, providing benefits for retirees, the disabled, and children of deceased workers.

Hourly Wage Rate

The amount of money paid for each hour of work performed, typically associated with part-time or contractual employment.

Gross Pay

The total compensation a person receives before any deductions or taxes are taken out.

Medicare Tax Rate

The percentage of an individual's or employer's earnings that is contributed to Medicare, a U.S. federal health insurance program.

Q6: When management seeks to achieve personal departmental

Q48: Widgeon Co. manufactures three products: Bales; Tales;

Q50: Blue Ridge Marketing Inc. manufactures two products,

Q76: The standard price and quantity of direct

Q78: At the beginning of the period, the

Q93: Purple Inc. production budget for Product X

Q96: Based on the following production and sales

Q112: Since the controllable variance measures the efficiency

Q145: What pricing concept considers the price that

Q154: A business is considering a cash outlay