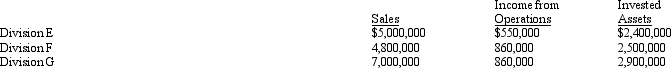

The sales, income from operations, and invested assets for each division of Grosbeak Company are as follows:

Definitions:

Good Networkers

Individuals proficient at building and maintaining professional relationships beneficial for career and business growth.

Reciprocate

To respond to a gesture or action by making a corresponding one, often related to mutual exchange or cooperation.

Résumé Length

The extent or measure of how long a CV or resume is, which can impact the perception of the candidate's qualifications or experience.

Formal Preparation

The process of systematically planning and organizing tasks or activities in advance, often for a specific event or purpose.

Q32: Make or buy options often arise when

Q37: Moon Company uses the variable cost concept

Q54: The Dawson Company manufactures small lamps and

Q74: Which of the following expenses incurred by

Q75: Which of the following can be used

Q99: The Clydesdale Company has sales of $4,500,000.

Q108: Division X of O'Blarney Company has sales

Q129: A manager is responsible for costs only

Q143: The Svelte Jeans Company produces two different

Q149: If at the end of the fiscal