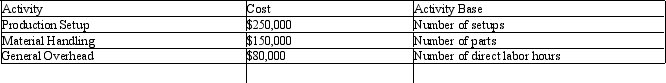

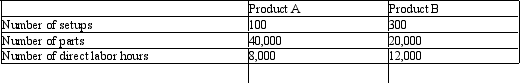

Miramar Industries manufactures two products, A and B. The manufacturing operation involves three overhead activities - production setup, material handling, and general factory activities. Miramar uses activity-based costing to allocate overhead to products. An activity analysis of the overhead revealed the following estimated costs and activity bases for these activities:  Each product's total activity in each of the three areas are as follows:

Each product's total activity in each of the three areas are as follows: What is the activity rate for Material Handling?

What is the activity rate for Material Handling?

Definitions:

Selling Price

The amount at which a product or service is sold to customers.

Operating Leverage

Operating Leverage is a measure of how a company's operating income changes with sales volume, indicating the proportion of fixed costs in total costs.

Variable Expenses

Expenses that vary directly with the amount of output or activity level.

Fixed Expenses

Costs that do not change in total with changes in the volume of activity, such as rent, salaries, and insurance premiums.

Q12: An investment of $185,575 is expected to

Q24: The use of standards for nonmanufacturing expenses

Q30: In using the variable cost concept of

Q35: The Beauty Beyond Words Salon uses an

Q39: Under the direct method of preparing a

Q85: The Kwanika Co. operates in a just-in-time

Q140: A responsibility center in which the authority

Q141: If a company records inventory purchases at

Q154: The amount of the estimated average income

Q194: Responsibility accounting reports for profit centers are