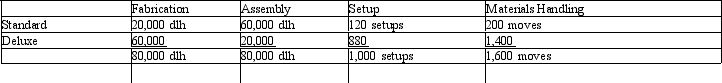

The Canine Company has total estimated factory overhead for the year of $2,400,000, divided into four activities: Fabrication, $1,200,000; Assembly, $480,000; Setup, $400,000; and Materials Handling $320,000. Canine manufactures two products: Standard Crates and Deluxe Crates. The activity-base usage quantities for each product by each activity are as follows:

Definitions:

Sales Salaries Expense

The total cost associated with compensating the sales force, including wages, commissions, and bonuses.

Work in Process

An inventory category that refers to partially completed goods awaiting completion and sale, standing between raw material and finished goods inventory.

Job Cost Sheets

Documents used to record and track the expenses associated with each specific job in a manufacturing process, including labor, materials, and overhead costs.

Control Account

An account used to summarize transactions recorded in subsidiary ledgers for a comprehensive total in the general ledger.

Q11: The Flapjack Corporation had 8,200 actual direct

Q12: Which of the following expressions is termed

Q28: The primary accounting tool for controlling and

Q40: The standard factory overhead rate is $10

Q58: The St. Augustine Corporation originally budgeted for

Q80: Falcon Co. produces a single product. Its

Q94: Three measures of investment center performance are

Q140: A responsibility center in which the authority

Q156: The following data is given for the

Q175: The process by which management plans, evaluates,