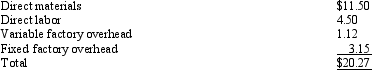

Snipe Company has been purchasing a component, Part Q, for $19.20 a unit. Snipe is currently operating at 70% of capacity and no significant increase in production is anticipated in the near future. The cost of manufacturing a unit of Part Q, determined by the absorption costing method, is estimated as follows:

Definitions:

Salvage Value

The assessed worth of an asset at the expiration of its life of usefulness.

Depreciation Expense

The organized spreading of a tangible asset's expense over the duration of its utility.

Useful Life

The estimated duration a fixed asset is expected to be economically usable, with normal repairs and maintenance.

Straight-Line Method

A depreciation technique that allocates an equal amount of depreciation to each year of the asset's useful life.

Q5: Challenger Factory produces two similar products -

Q10: The management of Wyoming Corporation is considering

Q15: Materials used by the Layton Company Division

Q44: When a bottleneck occurs between two products,

Q51: Prepare an income statement (through income before

Q58: The St. Augustine Corporation originally budgeted for

Q60: Multiple production department factory overhead rates are

Q90: Non-financial accounting information is used more often

Q117: If divisional income from operations is $100,000,

Q142: The Everest Company has income from operations