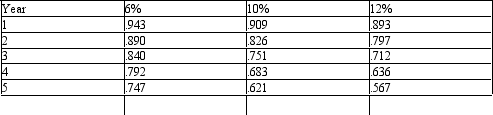

Below is a table for the present value of $1 at Compound interest.  Below is a table for the present value of an annuity of $1 at compound interest.

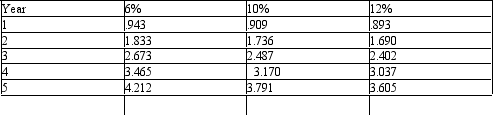

Below is a table for the present value of an annuity of $1 at compound interest. Using the tables above, what would be the internal rate of return of an investment that required an investment of $189,550, and would generate an annual cash inflow of $50,000 for the next 5 years?

Using the tables above, what would be the internal rate of return of an investment that required an investment of $189,550, and would generate an annual cash inflow of $50,000 for the next 5 years?

Definitions:

Relative Refractory Period

A period shortly after the firing of a nerve during which the nerve cannot be stimulated to fire again at its maximum rate, but can still respond to a stronger than usual stimulus.

Firing Rate

The frequency at which a neuron discharges electrical impulses over a certain period of time.

Absolute Refractory Period

The period immediately following an action potential during which a neuron is completely unable to fire another action potential, regardless of the strength of the stimulus.

Action Potential

A temporary inversion of the electrical potential across the membrane of a nerve or muscle cell, allowing for the transmission of signals.

Q5: Challenger Factory produces two similar products -

Q7: The Camper's Edge Factory produces two products

Q44: Aquatic Corp.'s standard material requirement to produce

Q47: Land costing $140,000 was sold for $173,000

Q57: A plantwide factory overhead rate assumes that

Q62: Two divisions of Central Company (Divisions X

Q83: Widgeon Co. manufactures three products: Bales; Tales;

Q97: A responsibility center in which the department

Q156: Cost plus methods determine the normal selling

Q168: Below is a table for the present