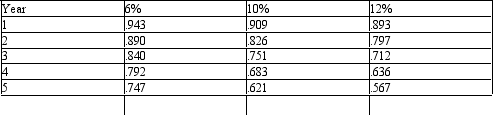

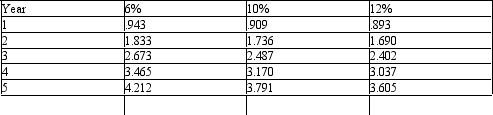

Below is a table for the present value of $1 at compound interest.  Below is a table for the present value of an annuity of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest. Using the tables above, what would be the present value of $15,000 (rounded to the nearest dollar) to be received at the end of each of the next two years, assuming an earnings rate of 6%?

Using the tables above, what would be the present value of $15,000 (rounded to the nearest dollar) to be received at the end of each of the next two years, assuming an earnings rate of 6%?

Definitions:

ROCE

Return on Capital Employed; a financial ratio that measures a company's profitability and the efficiency with which its capital is used.

Financing Charges

Interest and other costs associated with borrowing funds or purchasing goods and services on credit.

ROE

Return on Equity; a financial ratio that measures the profitability of a company in relation to the amount of equity, indicating how effectively shareholder equity is being utilized to generate profits.

Financial Leverage

Employing borrowed funds to amplify the potential gains from an investment, while also elevating the likelihood of incurring losses.

Q6: Under the total cost concept, manufacturing cost

Q40: The Anazi Leather Company manufactures leather handbags

Q43: Panamint Systems Corporation is estimating activity costs

Q79: The condensed income statement for a business

Q79: Schedule of Activity Costs <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2143/.jpg" alt="Schedule

Q93: In addition to the differential costs in

Q96: The budget for Department 10 of Treble

Q113: Push manufacturing (made-to-stock) is a traditional approach

Q159: The acquisition of land in exchange for

Q169: ABC Corporation has three service departments with