Project A requires an original investment of $65,000. The project will yield cash flows of $15,000 per year for seven years. Project B has a calculated net present value of $5,500 over a five year life. Project A could be sold at the end of five years for a price of $30,000. (a) Using the proper table below determine the net present value of Project A over a five-year life with salvage value assuming a minimum rate of return of 12%. (b) Which project provides the greatest net present value?

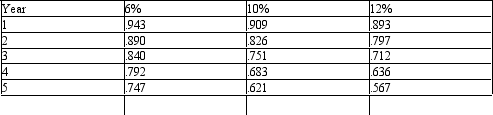

Below is a table for the present value of $1 at compound interest.

Definitions:

Year 2

Typically refers to the second year of a given time frame, period of analysis, or the second year of operation or study.

Gross Margin Percentage

A metric that shows the percentage of sales revenue remaining after subtracting the cost of goods sold, often used to evaluate business performance.

Year 2

Generally refers to the second year in a given context, such as the second year of a company's operations or a multi-year study.

Times Interest Earned Ratio

A financial metric used to measure a company's ability to meet its debt obligations, calculated by dividing earnings before interest and taxes (EBIT) by interest expenses.

Q11: Flyer Company sells a product in a

Q26: Selected data taken from the accounting records

Q50: A company is considering purchasing a machine

Q59: In a just-in-time (JIT) environment, process problems

Q80: Falcon Co. produces a single product. Its

Q81: Current position analysis indicates a company's ability

Q100: The Stewart Cake Factory owns a building

Q101: Due to Medicare reimbursement cuts, Loving Home

Q106: In an investment center, the manager has

Q168: Below is a table for the present