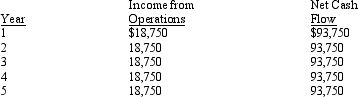

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The net present value for this investment is:

The net present value for this investment is:

Definitions:

Market Allocation

A method of distributing goods and services among buyers and sellers wherein prices are determined by supply and demand forces in the market.

Regulatory Agencies

Governmental bodies responsible for overseeing, implementing, and enforcing laws and regulations within specific sectors.

Secondary Effects

The indirect impact of an event or policy that may not be easily and immediately observable. In the area of policy, these effects are often both unintended and overlooked.

Future Crises

Potential, unforeseen events that could lead to severe economic, social, or environmental problems.

Q5: Which of the following drives work-in-process inventory

Q10: Cash dividends of $50,000 were declared during

Q14: A single plantwide overhead rate method is

Q50: Which equation better describes Target Costing?<br>A) Selling

Q54: The management of Indiana Corporation is considering

Q70: The following information is available from the

Q76: The Turtle Company has total estimated factory

Q76: Selected data for the current year ended

Q86: An anticipated purchase of equipment for $580,000,

Q193: A financial statement showing each item on