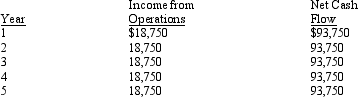

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The present value index for this investment is:

The present value index for this investment is:

Definitions:

Q7: Reducing wait time is directly linked to

Q15: Materials used by the Layton Company Division

Q40: A qualitative characteristic that may impact upon

Q44: Christmas Express makes wreaths in batch sizes

Q54: The profit margin component of rate of

Q77: When several alternative investment proposals of the

Q91: Maximum effectiveness and efficiency are reached when

Q96: If the budgeted factory overhead cost is

Q143: Materials used by Square Yard Products Inc.

Q168: Below is a table for the present