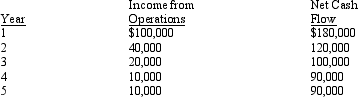

The management of Zesty Corporation is considering the purchase of a new machine costing $400,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The cash payback period for this investment is:

The cash payback period for this investment is:

Definitions:

Stimulus Control

A behavior modification technique that involves changing the environment to reduce undesired behaviors by associating them with different cues.

Time Sampling

A research method in which observations are made at specific intervals over a defined period to gather data.

Self-monitors

Individuals who regulate their behavior to accommodate social situations.

Covert Positive Reinforcement

The use of positive stimuli to increase the likelihood of a desired behavior occurring, without the individual being explicitly aware of it.

Q11: Sales reported on the income statement were

Q22: Assuming that the quantities of inventory on

Q25: Several items are missing from the following

Q54: A business received an offer from an

Q71: Activity-based costing provides more accurate and useful

Q76: A company is planning to purchase a

Q83: Prevention costs and appraisal costs are considered

Q107: Robin Company purchased and used 520 pounds

Q112: Income from operations of the Commercial Aviation

Q145: What pricing concept considers the price that