A project has estimated annual cash flows of $95,000 for four years and is estimated to cost $260,000. Assume a minimum acceptable rate of return of 10%. Using the following tables determine the (a) net present value of the project and (b) the present value index, rounded to two decimal places.

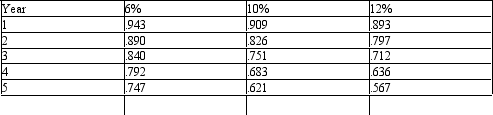

Below is a table for the present value of $1 at compound interest.

Definitions:

Evolutionary Stable Strategy

A strategy in game theory that, if adopted by a population in a competitive environment, cannot be invaded by any alternative strategy due to its superior success.

Payoffs

The gains or losses realized as a result of a decision or action in a game or transaction.

Business Dealings

Any activity or transaction between companies or individuals in the conduct of their commerce or trade.

Isolated Town

A settlement that is significantly distant from other populated areas, often facing unique economic and social challenges.

Q2: A disadvantage to using the residual income

Q5: Challenger Factory produces two similar products -

Q10: Tibet Company sells glasses, fine china, and

Q30: A business issues 20-year bonds payable in

Q37: The following financial information was summarized from

Q67: Widgeon Co. manufactures three products: Bales; Tales;

Q68: Which of the following is a cost

Q80: Multiple production department factory overhead rates are

Q116: Cash paid for equipment would be reported

Q126: The anticipated purchase of a fixed asset