Project A requires an original investment of $65,000. The project will yield cash flows of $15,000 per year for seven years. Project B has a calculated net present value of $5,500 over a five year life. Project A could be sold at the end of five years for a price of $30,000. (a) Using the proper table below determine the net present value of Project A over a five-year life with salvage value assuming a minimum rate of return of 12%. (b) Which project provides the greatest net present value?

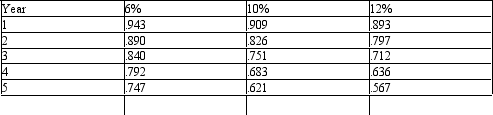

Below is a table for the present value of $1 at compound interest.

Definitions:

Low-Conflict

Situations characterized by minimal opposition or disagreement, often easier to manage or resolve.

Bargaining Situation

A scenario where two or more parties negotiate terms and conditions to reach a mutual agreement.

Activated Stereotype

A stereotype that comes to mind automatically and influences perception or behavior without conscious intention.

Actual Gender

The real or lived gender identity of an individual, which may or may not align with their gender assigned at birth.

Q20: The expected average rate of return for

Q43: Vertical analysis refers to comparing the financial

Q55: If the activities causing overhead costs are

Q90: Non-financial accounting information is used more often

Q97: Free cash flow is cash from operations,

Q116: The production department is proposing the purchase

Q146: All of the following qualitative considerations may

Q160: The Eastern Division of Kentucky Company has

Q172: Materials used by Square Yard Products Inc.

Q178: Below is a table for the present