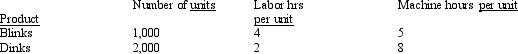

The Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

The Ramapo Company uses a single overhead rate to apply all overhead costs based on labor hours. What is the overhead cost per unit for Blinks?

Definitions:

Direct Materials

These are the raw materials that are directly incorporated into a finished product.

Standard Cost Card

A document that lists the standard costs associated with producing a single unit of a product, including materials, labor, and overhead.

Fixed Manufacturing Overhead

Expenses related to production that remain constant regardless of output quantity, including lease payments, employee wages, and insurance premiums.

Direct Labor Costs

These are the wages paid to workers who are directly involved in manufacturing or producing a product.

Q5: Challenger Factory produces two similar products -

Q15: Scoresby Co. uses 3 machine hours and

Q25: The board of directors declared cash dividends

Q54: Operating expenses other than depreciation for the

Q89: The Ramapo Company produces two products, Blinks

Q101: Due to Medicare reimbursement cuts, Loving Home

Q150: Jamison Company produces and sells Product X

Q169: ABC Corporation has three service departments with

Q170: The management of Idaho Corporation is considering

Q195: The Creative Division of the Barry Company