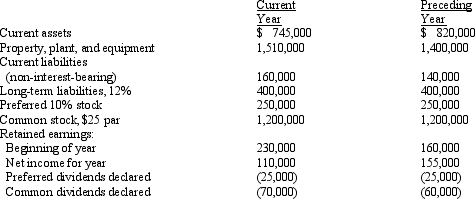

From the following data, determine for the current year the (a) rate earned on total assets, (b) rate earned on stockholders' equity, (c) rate earned on common stockholders' equity, (d) earnings per share on common stock, (e) price-earnings ratio on common stock, and (f) dividend yield on common stock. Assume that the current market price per share of common stock is $25. (Present key figures used in your computations.)

Round percentage values to one decimal place, dollar values to two decimal places, and other ratios to one decimal place.

Definitions:

Risky Securities

Financial instruments that carry a high degree of investment risk due to their significant exposure to market volatility.

Diversifiable Risk

The risk that a borrower will not pay theinterest and/or principal on a loan as it becomes due. Ifthe issuer defaults, investors receive less than the promised return on the bond. Default risk is influenced byboth the financial strength of the issuer and the terms ofthe bond contract, especially whether collateral has beenpledged to secure the bond. The greater the default risk,the higher the bond’s yield to maturity.

Required Rate

The minimum annual percentage return an investment must earn to be considered a viable option.

Nondiversifiable Risk

A type of investment risk that cannot be mitigated or eliminated through portfolio diversification, often associated with market-wide risks.

Q6: The last item on the statement of

Q33: As production occurs, materials, direct labor, and

Q41: <br>Refer to Figure 6-7.What is the number

Q47: Which of the following is not a

Q47: Quantity price standards<br>A) are standard price multiplied

Q64: Beginning inventory consisted of 1,000 units with

Q68: Which of the following is a cost

Q81: Current position analysis indicates a company's ability

Q120: The following forecasted sales pertain to Reject

Q128: Cash, as the term is used for