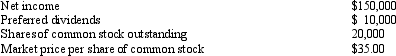

A company reports the following:

Definitions:

Unit Product Cost

The total cost associated with manufacturing a single unit of product, which includes direct materials, direct labor, and overhead.

Unit Product Cost

The total cost (including materials, labor, and overhead) divided by the number of units produced, indicating the cost to produce each unit of product.

Absorption Costing

A cost accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed overhead - in the cost of a product.

Unit Product Cost

The total cost (both variable and fixed costs) associated with producing a single unit of a product.

Q3: On the statement of cash flows prepared

Q28: Schedule of Activity Costs <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2143/.jpg" alt="Schedule

Q44: A company with working capital of $720,000

Q60: <br>What is the overhead rate for

Q64: Which of the following should be deducted

Q69: When budgets are used to evaluate performance,

Q97: Free cash flow is cash from operations,

Q122: <br>Refer to Figure 6-12.What are the

Q130: The tendency of the rate earned on

Q191: In computing the rate earned on total