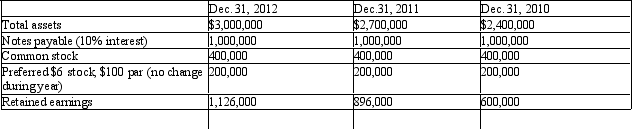

The following selected data were taken from the financial statements of the Berrol Group for December 31, 2012, 2011, and 2010:

The 2012 net income was $242,000 and the 2011 net income was $308,000. No dividends on common stock were declared between 2010 and 2012.

The 2012 net income was $242,000 and the 2011 net income was $308,000. No dividends on common stock were declared between 2010 and 2012.

Required:

(1) Determine the rate earned on total assets, the rate earned on stockholders' equity, and the rate earned on common stockholders' equity for the years 2012 and 2011. Round to one decimal place.

(2) What conclusion can be drawn from these data as to the company's profitability?

Definitions:

Income Statement

A financial statement that shows a company's revenues, expenses, and profitability over a specified period of time, providing insight into its financial performance.

Absorption Costing

An accounting method where all manufacturing costs, including both fixed and variable costs, are allocated to produced units.

Direct Labor Cost

The total cost of wages paid to workers directly involved in manufacturing a product or delivering a service.

Fixed Manufacturing Overhead

The total of all manufacturing costs that do not vary with the level of production, such as rent, salaries, and insurance.

Q15: The comparative balance sheet of Ramos Company

Q16: The standard cost sheet includes all of

Q39: Which is NOT a difference between the

Q39: Unusual items affecting the current period's income

Q53: Lead time reduction can be a cost-saving

Q66: Sifton Electronics Corporation manufactures and assembles electronic

Q91: Which of the following is required by

Q111: Refer to Figure 8-8.The budgeted cost for

Q134: Which of the following allocation methods fully

Q148: If the static budget variance for materials