Figure 8-7 Schrandt Company, an importer and retailer of Polish pottery and kitchenware, prepares a monthly master budget.Data for the July master budget are given below:

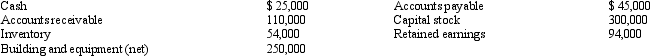

The June 30th balance sheet follows: Actual sales for June and budgeted sales for July, August, and September are given below:

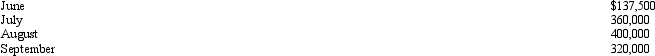

Actual sales for June and budgeted sales for July, August, and September are given below: Sales are 20 percent for cash and 80 percent on credit.All credit sales are collected in the month following the sale.There are no bad debts.

Sales are 20 percent for cash and 80 percent on credit.All credit sales are collected in the month following the sale.There are no bad debts.

The gross margin percentage is 40 percent of sales.The desired ending inventory is equal to 25 percent of the following month's sales.One fourth of the purchases are paid for in the month of purchase and the others are purchased on account and paid in full the following month.

The monthly cash operating expenses are $43,000, and the monthly depreciation expenses are $7,000.

-

Refer to Figure 8-7.What is the balance of the accounts receivable at the end of July?

Definitions:

Multifactor Model

An investment model that seeks to describe the expected returns on a security based on various risk factors, providing a more comprehensive view than models based on a single factor.

Market Indexes

Benchmarks that track the performance of a specific basket of stocks, representing a particular sector or the market as a whole.

Chen, Roll, and Ross

Refers to a model developed by the economists Stephen A. Ross, Randolph W. Roll, and Edwin H. Chen that enhances the capital asset pricing model by including factors related to macroeconomic risk.

Multifactor Models

Financial models that use multiple variables to explain or predict asset prices and returns, incorporating factors like size, value, and momentum.

Q14: Foster Company incurred $200,000 to manufacture the

Q21: <br>Refer to Figure 6-12.What is the

Q64: The following standard costs were developed for

Q65: Volume variances examine differences between<br>A) the static

Q71: Beginning inventory consisted of 10,000 units (20

Q83: When the rate of return on total

Q129: The ratio of the sum of cash,

Q135: Transferred-in costs are accounted for in the

Q153: The main disadvantage of the direct method

Q159: The acquisition of land in exchange for