Lake Corporation manufactures two products, AA and BB, from a joint process.A production run costs $20,000 and results in 500 units of AA and 2,000 units of BB.Both products must be processed past the split-off point, incurring separable costs of $5 per unit for AA and $10 per unit for BB.The market price is $25 for AA and $20 for BB.

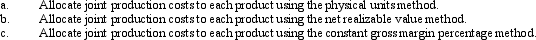

Required:

Definitions:

Annual Cost

The total amount spent on a particular item, service, or operation over the course of a year.

Insurance Claims

Requests made to an insurance company for payment based on the terms of an insurance policy.

Medical Practice

The profession or activity of providing care to patients, involving diagnosis, treatment, and prevention of diseases.

Filing Limit

The maximum time period allowed after an event within which legal proceedings may be initiated or claims must be submitted.

Q35: A company reports the following:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2143/.jpg"

Q60: <br>Refer to Figure 8-4.The expected cash collections

Q63: <br>Refer to Figure 4-4.If factory overhead is

Q76: If activity-based costing is used, insurance on

Q90: Godwin Corporation produces specially machined parts.The parts

Q92: _ are products with substantial value which

Q95: The following information was available about supplies

Q122: Refer to Figure 4-8.Using functional-based costing, what

Q123: Which of the following is NOT a

Q127: The particular analytical measures chosen to analyze