FIGURE 7-4 Xi Print operates a copy business at two different locations.Xi Print has one support department that is responsible for cleaning, service, and maintenance of its copying equipment.The costs of the support department are allocated to each copy center on the basis of total copies made.

During the first month, the costs of the support department were expected to be $200,000.Of this amount, $60,000 is considered a fixed cost.During the month, the support department incurred actual variable costs of $128,000 and actual fixed costs of $72,000.

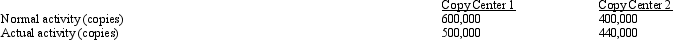

Normal and actual activity (copies made) are as follows:

- Refer to Figure 7-4.For purposes of performance evaluation, fixed costs allocated to Copy Center 2 are

Definitions:

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in an equal yearly amount.

Renovation Cost

The total expenses incurred during the process of improving or updating a property.

Initial Investments

Capital outlay at the start of a project, including costs for acquiring assets, setup, and other expenses necessary for the beginning of operations.

After-Tax Discount Rate

The discount rate used in investment appraisal and financial analysis that takes into account the effect of taxes on the rate of return.

Q3: Anderson Company pays a flat fee of

Q23: Leveraging implies that a company<br>A) contains debt

Q25: The board of directors declared cash dividends

Q27: <br>Refer to Figure 4-21.Under this new approach,

Q34: Direct labor costs are assigned to individual

Q38: <br>Refer to Figure 5-4.What is the total

Q63: Refer to Figure 7-6.Using the direct

Q73: <br>Refer to Figure 6-6.What are the equivalent

Q109: The following information pertains to Newman Company.

Q127: Activity-based budgets<br>A) use the knowledge of cost