Otto Inc.began the current period with no inventories.During the period, it processed 50,000 pounds of materials costing $450,000.Conversion costs incurred during the period amounted to $660,000.The firm ended the period with no work-in-process.During the period, the firm produced 16,000, 24,000, and 10,000 units of X, Y, and Z, respectively.All costs are considered joint costs.The firm sold 12,000 units of X, 16,000 units of Y, and 9,000 units of Z.X sells for $30 per unit, Y for $44 per unit, and Z for $4 per unit.The firm uses the net realizable value method for cost allocation.Z is considered a by-product.

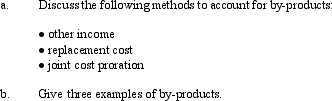

Required:

Definitions:

Semiannual Interest

Interest that is calculated and paid twice a year on investments or loans.

Straight-line Method

A method of allocating an asset's cost evenly across its useful life.

Installment Note Payable

A debt or loan that is to be returned to the lender in regular periodic payments.

Accrue Interest

The process of recognizing interest expense or income that has been incurred but not yet paid or received in cash.

Q26: Boss Company currently leases a delivery van

Q47: Quantity price standards<br>A) are standard price multiplied

Q63: The following information pertains to North Company:

Q70: Refer to Figure 9-1.What is the

Q87: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2143/.jpg" alt=" Based on the

Q95: The following information was available about supplies

Q95: The proportion of an overhead activity consumed

Q101: <br>Refer to Figure 5-6.What is the ending

Q159: Which of the following is NOT an

Q162: Income statement information for Sharif Corporation is