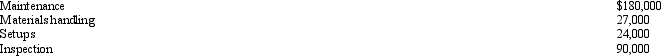

Figure 4-14 Spear Manufacturing has four categories of overhead.The four categories and expected overhead costs for each category for next year are as follows: Currently, overhead is applied using a predetermined overhead rate based upon budgeted direct labor hours.20,000 direct labor hours are budgeted for next year.

Currently, overhead is applied using a predetermined overhead rate based upon budgeted direct labor hours.20,000 direct labor hours are budgeted for next year.

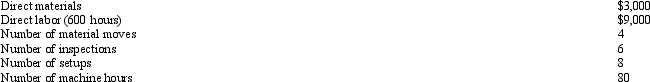

The company has been asked to submit a bid for a proposed job.The plant manager feels that obtaining this job would result in new business in future years.Usually bids are based upon full manufacturing cost plus 15 percent.Estimates for the proposed job are as follows: In the past, full manufacturing cost has been calculated by allocating overhead using a volume-based activity driver, direct labor hours.The plant manager has heard of a new way of applying overhead that uses cost pools and activity drivers.Expected activity for the four activity drivers that would be used are:

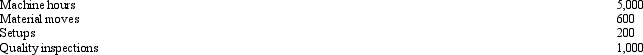

In the past, full manufacturing cost has been calculated by allocating overhead using a volume-based activity driver, direct labor hours.The plant manager has heard of a new way of applying overhead that uses cost pools and activity drivers.Expected activity for the four activity drivers that would be used are:

- Refer to Figure 4-14.If material moves are used to assign material handling costs, the amount of material handling costs allocated to the proposed job would be

Definitions:

Interest Tax Shield

A lowered income tax obligation stemming from approved deductions on interest expenses.

Levered Firm

A company that uses debt (loans or bonds) in addition to equity in its financing structure, often leading to higher risk and potentially higher returns.

M&M Proposition I

A theory in corporate finance suggesting that in a perfect market, the value of a firm is unaffected by how it is financed, regardless of the debt-to-equity ratio.

Unlevered Cost of Capital

The cost of capital for a company that has no debt, reflecting the risk of investing in the company's equity alone.

Q26: In developing unit costs, overhead costs should

Q42: Which of the following costs is NOT

Q58: Which of the following is NOT an

Q65: Sargent Corporation is considering an investment in

Q67: Russell Company has the following data pertaining

Q75: Materials are added to a second production

Q78: Common measures of production activity include<br>A) units

Q83: In a process costing system, which of

Q91: Which of the following firms would make

Q91: If operations run on less than full