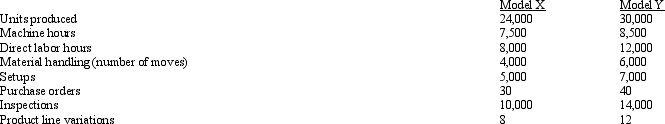

Figure 4-21 Jones Manufacturing uses an activity-based costing system.The company produces Model X and Model Y.Information relating to the two products is as follows: The following overhead costs are reported for the following activities of the production process:

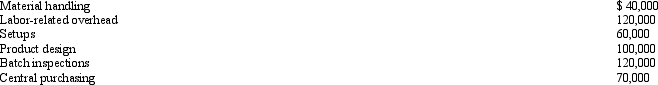

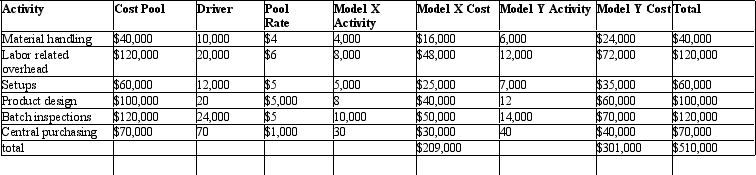

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models X and Y as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models X and Y as given in the table below: Jones Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Jones Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-

Refer to Figure 4-21.Under this new approach using consumption ratios for labor related and machine hours, the overhead assigned to labor related activities would be? (round to 5 decimal places)

Definitions:

Visual Icons

Symbolic images or figures that represent a particular idea, theme, or brand, recognized universally.

Trademarks

Trademarks are distinctive signs or symbols used by a business to identify and legally protect its products or services from being copied or exploited by competitors.

Foreign Corrupt Practices Act

A United States law that prohibits American companies and individuals from bribing foreign government officials to benefit their business operations.

International Anti-Dumping

Measures and agreements designed to prevent companies from exporting goods at prices lower than their home market prices, which can harm the importing country's industries.

Q11: Which of the following is an example

Q30: Refer to Figure 4-3.The amount of

Q32: <br>Refer to Figure 6-10.If materials were added

Q46: Jacob Company has two support departments, Maintenance

Q58: Which of the following costs are considered

Q65: Lee Company began making lipstick in October

Q106: Walter Company uses a job-order costing system

Q123: What is one of the potential disadvantages

Q129: _ result when organizations acquire many multiperiod

Q135: Lopez Manufacturing prices its products at full