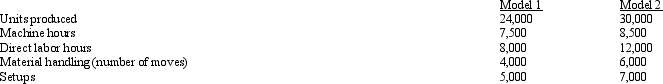

Figure 4-15 Quint Manufacturing uses an activity-based costing system.The company produces Model 1 and Model 2.Information relating to the two products is as follows: The following costs are reported:

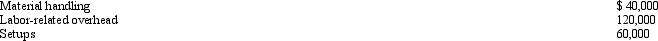

The following costs are reported:

-Refer to Figure 4-15.Labor-related overhead costs assigned to Model 1 are

Definitions:

Excise Tax

A tax levied on specific goods, services, or transactions, usually to discourage their use or generate revenue.

Tariff

A levy enforced by the government on products and services that are brought in from foreign countries.

Domestic Producers

Local manufacturers and suppliers who produce goods within a country's borders.

Imported Good

A product or service that is brought into one country from another to be sold or used.

Q8: <br>Refer to Figure 4-13.Using activity-based costing and

Q18: Theory of constraints focuses on what three

Q28: Baker Enterprises developed a cost function for

Q29: Refer to Figure 5-7.What is the plantwide

Q35: In the formula Y = F +

Q37: The following information is provided for the

Q51: A predetermine overhead rate is calculated using

Q66: Conversion costs do NOT include<br>A) direct materials.<br>B)

Q86: Refer to Figure 6-4.What are the

Q127: The use of unit-based activity drivers to