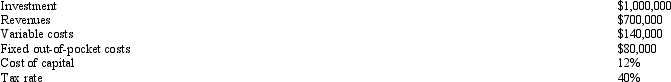

Information about a project Darcy Company is considering is as follows:  The property is considered 5-year property for tax purposes.The company plans to use MACRS and dispose of the property at the end of the sixth year.No salvage value is expected.Assume all cash flows occur at the end of the year.Round amounts to dollars.

The property is considered 5-year property for tax purposes.The company plans to use MACRS and dispose of the property at the end of the sixth year.No salvage value is expected.Assume all cash flows occur at the end of the year.Round amounts to dollars.

The tax savings from depreciation in Year 2 would be

Definitions:

Q14: The operations of Smits Corporation are divided

Q18: If the tax rate is 40 percent

Q19: Tactical decision making relies<br>A) only on relevant

Q20: Baker Company sells its product for $60.In

Q32: Which of the following statements is TRUE

Q50: Which of the following is NOT an

Q82: Which of the following expenses incurred by

Q82: Place Corporation had the following income statement

Q102: Refer to Figure 14-2.For the current

Q104: Refer to Figure 3-6.Using a computer or