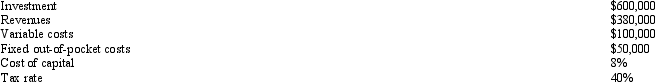

Information about a project Wagner Company is considering is as follows:  The property is considered 5-year property for tax purposes.The company plans to use MACRS and dispose of the property at the end of the sixth year; no salvage value is expected.Assume all cash flows occur at the end of the year.Round amounts to dollars.

The property is considered 5-year property for tax purposes.The company plans to use MACRS and dispose of the property at the end of the sixth year; no salvage value is expected.Assume all cash flows occur at the end of the year.Round amounts to dollars.

The tax savings from depreciation in Year 2 would be

Definitions:

Delegate

To assign responsibility or authority to another individual, typically to lighten one's own workload or to entrust tasks to more specialized personnel.

Skills and Confidence

The combination of abilities and self-assurance that enables an individual to perform tasks effectively and believe in their capacities.

Subordinate Jobs

Positions within an organization that fall below the managerial or leadership levels, typically involving more direct task execution under supervision.

Substantial Delegation

refers to transferring a considerable amount of decision-making power or responsibility from superiors to subordinates in an organization.

Q2: Which of the following could be considered

Q14: The system will cost $9,000,000 and will

Q21: The income statement for Thomas Manufacturing Company

Q26: What is the partial operational productivity

Q40: Maple Management Services is considering an investment

Q43: What is the labor productivity ratio

Q52: <br>Refer to Figure 3-1.Compute the total variable

Q54: Which of the following is true in

Q62: Refer to Figure 2-15.What are the

Q106: The Waldo Company had the following functional