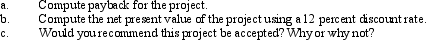

A capital investment project requires an investment of $450,000.It has an expected life of six years with an annual cash flow of $90,000 received at the end of each year.The company uses the straight-line method of depreciation with no mid-year convention.Ignore income taxes.

Required:

Definitions:

Current Assets

Assets owned by a company that are expected to be converted into cash, sold, or consumed within a year or within the operating cycle.

Gross Profit

The difference between total revenue and the cost of goods sold, before deducting any selling, administrative, or other expenses.

Gross Profit

The difference between sales revenue and the cost of goods sold, before deducting overheads, salaries, and other operating expenses.

Stockholders' Equity

The residual interest in the assets of an entity that remains after deducting its liabilities.

Q7: Which of the following costs is NOT

Q9: The drum-buffer-rope system is another name for<br>A)

Q11: Which of the following is an example

Q22: Following is information pertaining to material that

Q30: Mitchell Services is considering an investment of

Q41: Which of the following is an example

Q43: The present value of $4,000 to be

Q68: Ramon Company reported the following units of

Q89: _ is a measure of how well

Q102: Refer to Figure 14-2.For the current