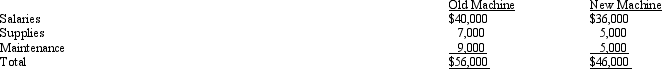

Dale Davis Company is evaluating a proposal to purchase a new machine that would cost $100,000 and have a salvage value of $10,000 in four years.It would provide annual operating cash savings of $10,000, as follows:

If the new machine is purchased, the old machine will be sold for its current salvage value of $20,000.If the new machine is not purchased, the old machine will be disposed of in four years at a predicted salvage value of $2,000.The old machine's present book value is $40,000.If kept, in one year the old machine will require repairs predicted to cost $35,000.

If the new machine is purchased, the old machine will be sold for its current salvage value of $20,000.If the new machine is not purchased, the old machine will be disposed of in four years at a predicted salvage value of $2,000.The old machine's present book value is $40,000.If kept, in one year the old machine will require repairs predicted to cost $35,000.

Dale Davis's cost of capital is 14 percent.

Required:

Should the new machine be purchased? Why or why not?

Definitions:

Perfectly Competitive

Refers to a market scenario where an unlimited number of buyers and sellers operate, and the single product offered is homogenous, making no single entity able to influence the market price.

Marginal Cost

The cost of producing one additional unit of a product or service, a crucial concept for optimizing production and pricing decisions.

Fixed Cost

Costs that do not vary with the level of output, remaining constant even if production is zero.

Variable Costs

Costs that change in proportion to the level of production or business activity, such as materials and labor directly involved in manufacturing.

Q8: Which of the following is NOT a

Q29: What is the contribution margin of

Q34: Assuming all other things are the same,

Q48: Which of the following is NOT a

Q60: Toshi Company incurred the following costs in

Q66: <br>Refer to Figure 18-1.What customer type is

Q76: The high-low method may give unsatisfactory results

Q95: When a company sells more units than

Q105: <br>Refer to Figure 15-1.What is the production

Q110: Which of the following decision-making tools would