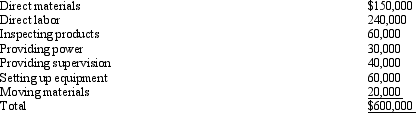

Foster Industries manufactures 20,000 components per year.The manufacturing cost of the components was determined as follows:  If the component is not produced by Foster, inspection of products and provision of power costs will only be 10 percent of the production costs; moving materials costs and setting up equipment costs will only be 50 percent of the production costs; and supervision costs will amount to only 40 percent of the production amount.An outside supplier has offered to sell the component for $25.50.

If the component is not produced by Foster, inspection of products and provision of power costs will only be 10 percent of the production costs; moving materials costs and setting up equipment costs will only be 50 percent of the production costs; and supervision costs will amount to only 40 percent of the production amount.An outside supplier has offered to sell the component for $25.50.

What is the effect on income if Foster Industries purchases the component from the outside supplier?

Definitions:

Quotas

Limits or targets set on quantities, such as the maximum amount of goods that can be imported or the sales targets for individuals or teams.

Foreign Competition

Refers to the competitive pressure that domestic companies face from foreign companies in the same industry, impacting market share, pricing, and innovation strategies.

Tariffs

Taxes imposed on imported goods, often used to protect domestic industries or generate revenue.

Imported Goods

Products brought into one country from another for the purpose of sale or trade.

Q12: Which of the following is NOT a

Q20: Nashville Company manufactures candy.The company buys chocolate

Q36: Which of the following is a reason

Q37: Environmental internal failure costs would be defined

Q48: Inventory balances for the James Enterprises in

Q59: In a traditional manufacturing company, product costs

Q67: On a profit-volume graph, the profit line

Q70: The following information pertains to an investment:

Q108: Error costs can be defined as<br>A) the

Q139: An example of additional revenue that might