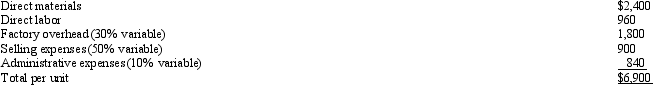

Reggie Corporation manufactures a single product with the following unit costs for 1,000 units:  Recently, a company approached Reggie Corporation about buying 100 units for $5,100 each.Currently, the models are sold to dealers for $7,800.Reggie Corporation's capacity is sufficient to produce the extra 100 units.No additional selling expenses would be incurred on the special order.

Recently, a company approached Reggie Corporation about buying 100 units for $5,100 each.Currently, the models are sold to dealers for $7,800.Reggie Corporation's capacity is sufficient to produce the extra 100 units.No additional selling expenses would be incurred on the special order.

-

How much will income change if the special order is accepted?

Definitions:

Medical Deductions

Expenses for healthcare that exceed a certain percentage of adjusted gross income and can be itemized for tax deductions, including payments for doctors, prescriptions, and certain medical equipment.

Floor

In finance, the lowest possible value or limit for prices, wages, or other financial variables.

Personal Casualty Loss

Financial loss resulting from the damage, destruction, or loss of an individual’s property from sudden, unexpected, or unusual events.

Deduction

An amount that can be subtracted from gross income to reduce the total taxable income, leading to lower tax liability.

Q30: What are some of the pricing practices

Q56: The following information relates to a product

Q57: Business strategy is concerned with<br>A) choosing market

Q57: The following information relates to Quaker Manufacturing:<br>To

Q78: The order fulfillment value stream focuses on<br>A)

Q83: The income statement for Thomas Manufacturing Company

Q93: Refer to Figure 14-4.For the current year,

Q115: Productivity is concerned with producing<br>A) output rapidly.<br>B)

Q132: <br>Refer to Figure 16-2.What is the production

Q132: If physical observation can NOT be used