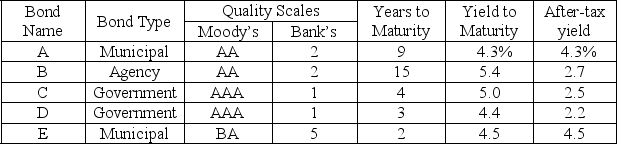

A portfolio manager in charge of a bank portfolio has $10 million to invest. The securities available for purchase, as well as their respective quality ratings, maturities, and yields, are shown in the table below:

The bank places the following policy limitations on the portfolio manager's actions:

1. Government and agency bonds must total at least $4 million.

2. The average quality of the portfolio cannot exceed 1.4 on the bank's quality scale. (Note that a low number on this scale means a high-quality bond.)

3. The average years to maturity of the portfolio must not exceed 5 years.

Assuming that the objective of the portfolio manager is to maximize after-tax earnings and that the tax rate is 50%, formulate a linear program that can be used to determine how much money to invest in each type of bond.

Definitions:

Cash Flow

The net amount of cash and cash equivalents being transferred into and out of a business.

Par Value

The face value of a bond, stock, or coupon as stated by the issuer, which is the minimum amount at which the security can be sold.

Preferred Stock

A class of ownership in a corporation with a higher claim on assets and earnings than common stock, typically with dividends that are paid out before dividends to common shareholders.

No-par Common Stock

No-par common stock is issued without a par value, and its value is determined by what investors are willing to pay for it, rather than being stated in the company's charter.

Q7: Compare the access differences among the Internet,

Q36: Companies want a supply chain that makes

Q39: For an optimization problem a(an) _ violates

Q53: Suppose that weekly output is worth $1000,

Q88: Visitors to a major amusement park would

Q91: McDonald's and Pizzerias compete on the same

Q92: In Linear Programming models, what do you

Q97: Who created "scientific management?"<br>A) James Watt<br>B) Adam

Q120: In the Excel MATCH function, which argument

Q129: Which of the following historical figures would