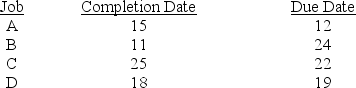

Using the following data, calculate the average job tardiness.

Definitions:

Variable Cost

Costs that vary in proportion to the volume of output or activity, such as materials and labor.

Monthly Interest Rate

The percentage of interest charged or earned on a loan or investment over a month.

Invoice Date

The date on which an invoice is generated, marking the beginning of the payment terms period.

Propellerhead Software

A music software company known for creating Reason, a popular digital audio workstation used by musicians and producers.

Q9: Which of the following statements is false?<br>A)

Q29: The onset of warm autoimmune hemolytic anemia

Q52: Material requirements planning is an information system

Q56: Jim-O's fast focus restaurant is opening up

Q57: When evaluating the production plan you should

Q59: Backward scheduling determines the earliest possible completion

Q103: The lead time can be less than

Q119: What does makespan measure?<br>A) WIP inventory<br>B) due-date

Q124: Which phase in the project life cycle

Q130: What are the steps involved when a