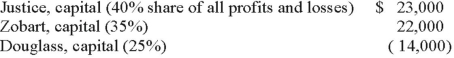

A local partnership was in the process of liquidating and reported the following capital balances:  Douglass indicated that the $14,000 deficit would be covered by a forthcoming contribution. However, the two remaining partners asked to receive the $31,000 that was then in the cash account.

Douglass indicated that the $14,000 deficit would be covered by a forthcoming contribution. However, the two remaining partners asked to receive the $31,000 that was then in the cash account.

How much of this money should Justice receive?

Definitions:

Shareholder

An individual or entity that owns shares in a corporation and has potential financial gains or losses based on the company's performance.

Corporation

A legal entity that is separate and distinct from its owners, possessing rights and responsibilities, capable of conducting business, entering into agreements, and owning property.

Novation

The act of replacing an obligation to perform with a new obligation, or replacing a party to an agreement with a new party.

Valid Obligation

A legal term denoting a binding duty or commitment that has been established through proper legal or contractual procedures, enforceable by law.

Q12: Ginvold Co. began operating a subsidiary in

Q13: Reciprocal transfers where both parties give and

Q16: The reporting of the fund balance of

Q19: Lucky Co. had cash of $65,000, inventory

Q20: On a statement of financial affairs, a

Q23: According to the text, all of the

Q24: A new hospital system has moved into

Q34: Which statement is false regarding the Statement

Q34: Describe workers' compensation. Include the rationale for

Q59: Why is a Schedule of Liquidation prepared?