Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

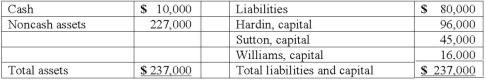

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

Definitions:

Disturbed Psychotics

Individuals with severe psychological disorders that disrupt their thinking, feeling, moods, and ability to relate to others.

Innate

Qualities or abilities that are inherent and naturally present in an individual from birth, not acquired through learning or experience.

Conscious Perception

The awareness and interpretation of sensory stimuli while one is awake and aware.

Unconscious Psychic Energy

A concept in psychoanalytic theory referring to the underlying energy that powers human drives and desires, often outside of conscious awareness.

Q4: What accounting topics were covered under the

Q27: Physician's Medicare payments are paid based on

Q28: In 2009, the U.S. spent _ on

Q31: Which entry would be the correct entry

Q38: The capital account balances for Donald &

Q39: Ginvold Co. began operating a subsidiary in

Q43: Coyote Corp. (a U.S. company in Texas)

Q67: A letter of comments would be issued

Q71: What happens when a U.S. company purchases

Q75: Briefly describe Regulation S-K. What is its