Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

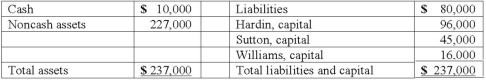

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Prepare journal entries to record the actual liquidation transactions.

Definitions:

Nasogastric Tube

A flexible tube that is passed through the nose into the stomach for feeding or draining stomach contents.

Nursing Assistant

A healthcare professional who provides basic care and assistance with activities of daily living to patients in various settings.

Nursing Faculty

Academic and clinical instructors responsible for educating nursing students in colleges or universities.

Emergency Department

A specialized department in a hospital that provides immediate care to patients with acute illnesses or injuries.

Q13: Which accounts are remeasured using current exchange

Q26: Which of the following are not authoritative

Q28: Which one of the following is a

Q28: Coyote Corp. (a U.S. company in Texas)

Q30: What is the minimum net worth of

Q49: Who must accept and confirm the Reorganization

Q55: The audit committee of an entity subject

Q60: As of January 1, 2013, the partnership

Q67: What events cause the dissolution of a

Q87: A spot rate may be defined as<br>A)